Disclaimer: The views expressed here are mine and may change without notice. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing. Please see important disclaimers here and here.

________________________________

Consider a company whose revenues are increasing, whose profits are increasing, and whose management is great. Can it be a bad investment candidate? It doesn't sound like it initially, but it could be a bad bet if the quality of key company tenets is not judged properly. Let’s examine this idea closely by evaluating a few business analysis items.

Stability of the Top-line

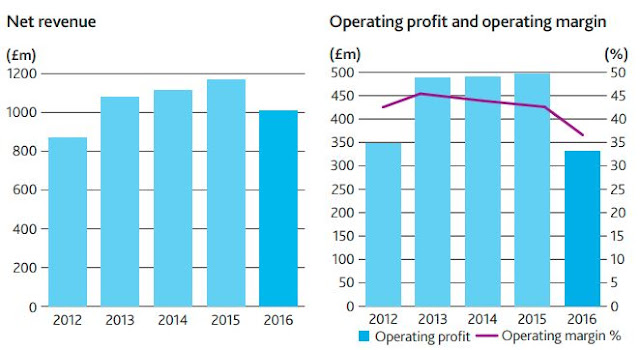

Judging the stability of the revenue is first in line. Is the company's growth sustainable? Here scrutinizing both recent and past data is important. Consider the case of Aberdeen Asset Management. It was one of the largest European investment companies listed on the London Stock Exchange. For an investment company, the stability of its raw material (capital source) is of prime importance. One of the sources of Aberdeen's funds were sovereign wealth funds. The conventional wisdom is that this source of capital is stable. However, looking under the hood of this capital base was important here. Most of the sovereign wealth fund’s capital came from oil-producing countries. As the oil price collapsed in 2015, these countries pulled out capital to make up for losses. That led to a decline in Aberdeen's assets and, thus, revenue. Because of the fixed cost nature of the business, profits suffered a bigger decline. So, what is the lesson here? An investor must fully understand the true quality of the revenue that a company generates. In Aberdeen's case, a seemingly stable asset was, in reality, highly unstable given its dependence on commodity prices.

source: Aberdeen annual 2016 report (fiscal year ends in September month)

Sometimes a company’s improved business performance deceives the true strength of its top line. Take the case of Cort Leasing which rents out furniture. The company grew at a healthy clip up to the year 2000. And, it was assumed that this was driven by a fundamental shift in the marketplace by which companies and people prefer to rent furniture versus buy furniture. However, the company's profit went from more than $40 million in 2000 to under $5 million in the next two years! How did that happen? It turns out the company's growth was driven by the startup boom of the late nineties rather than any fundamental shift in customer preference. Mr. Munger quoted this as a macroeconomic mistake. What's the lesson in this case? That it is important to go one layer down to understand the core drivers of the revenue growth, and not make decisions based on macroeconomic trends.

Fundamental Business Economics

It is common for a company's management to increase profit margins, and in most cases that enthuses investors. However, this behavior should be scrutinized very carefully. For example, increasing margin with disregard to inventory turns does no good to fundamental return on capital of the business. A recent example is of an IT services company. The company shows in its marketing presentation that it has increased its profit margin from fiscal year FY2016 to FY2020. However, the investor has to carefully look at the company filings to figure out the trajectory of the time the company takes to convert its investments in working capital into cash flows from sales (also called cash conversion cycle). For this company, the cash conversion cycle doubled from FY2016 to FY2020. What is the takeaway? It is crucial to understand the fundamental economics of the business that drives the company returns.

Pricing Power

One of the common narratives I have heard among the investment community is that a company with pricing power is a good business. That certainly can be true but it should not be applied in the literal sense. If a business has a dominant presence in a market or product category, it can't have unlimited pricing power. Thus, businesses should be careful here. In the current business environment, I see some similarities of this dynamic among US cable companies. Most cable companies in the US are little monopolies. Some of the top cable companies are increasing the prices of internet service. In effect, taking advantage of their market position. But, others are following a volume first strategy (focus on getting customers versus increasing prices). Whose business model is more sustainable? It seems to me it is ingrained in human behavior (rich or poor) to pay less for a product assuming product quality isn't compromised much. If the end customer is forced to use a company’s product, that customer will likely be the first to abandon the product when a substitute comes in. So, companies that keep on raising prices makes me nervous about their future despite their market dominance.

To conclude, as investors analyze various businesses it is imperative to understand the quality of various tenets that affect the company's economics. I’d like to emphasize that there is a long list of such items that are impossible to encapsulate in a few paragraphs. So this is post is just the short version. The investor has to dig into the company's business history, financial statements, and other sources to make a full and proper assessment of the quality of the key tenets.

Abhay Srivastava is the Founder and Managing Member of AS Investment Partners LLC, a value investing firm (www.asinvpartners.com).